how to pay indiana state tax warrant

Harrison County arrest records are official documents providing summaries of the frequency of arrests from criminal activity in the county. A payment submitted by You through this Tax Warrant Collection System implies Your compliance with the law.

Dentons Indiana Tax Developments Fall 2020

Our service is available 24 hours a day 7 days a week from any location.

. About Doxpop Tax Warrants. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. A tax warrant is equivalent to a civil judgment against you and protects New York States interests and priority in the collection of outstanding tax debt.

Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following. If you are disputing the amount owed call the Department of Revenue at 317-232-2240. Whether the taxpayer owed the tax for which the warrant was issued.

The demand notice for payment link includes information about possible remedies to address the demand before it becomes a warrant for collection of tax. Pay a bill through INTIME. Office of Trial Court Technology.

Warrant lists will be updated weekly - errors will be researched and removed once confirmed with the courts. Doxpop provides access to over current and historical tax warrants in Indiana counties. Plan B is if you.

Any errors should be reported to the Clark County Sheriffs Office at 937-521-2055. Make a payment plan payment. Whether the warrant is subject to any.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional. We will also notify the Department of State that the tax warrant has been satisfied. You must pay your total warranted balance in full to satisfy your tax warrant.

Line 26 Amount Due Payment OptionsThere are several ways to pay the amount you. Pay by check or money order. Property that is illegal to possess.

Indiana State Tax Warrant Information. The terms of your payment plan depend on who is collecting your Indiana tax debt. Find Indiana tax forms.

Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. Pay your Indiana tax return. Do not call the Hamilton County Sheriffs Office as this agency has nothing to.

Whether the warrant was properly issued according to statute or DOR procedures. If a collection agency handles your tax warrant. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency.

When you filed your state return TT would have told you the various options as follows. Your Indiana tax debt might be being collected by 1 or more of the 3 agencies listed below. If you have questions about your Indiana tax warrant you can call the Indiana DOR at 317-232-2240.

Information about novel coronavirus COVID-19 INgov. These taxes may be for individual income sales tax withholding. The court system in Missouri keeps a comprehensive public database hosting warrants court judgments and chargesA requestor may use the platform by entering the last name of the.

Plan A is to take care of your taxes early on to avoid penalties and interest a tax warrant and a tax lien on your credit report which stays on your credit for seven years. This Tax Warrant Collection System is designed to help You to make. They also provide information on arrest warrants.

What is a tax warrant. You can set up a. Know when I will receive my tax refund.

To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to. Check status of payment.

Tax Lien States The Complete List Plus Advice

Is Indiana A Tax Lien State Youtube

Covid 19 Resources Indiana State Bar Association

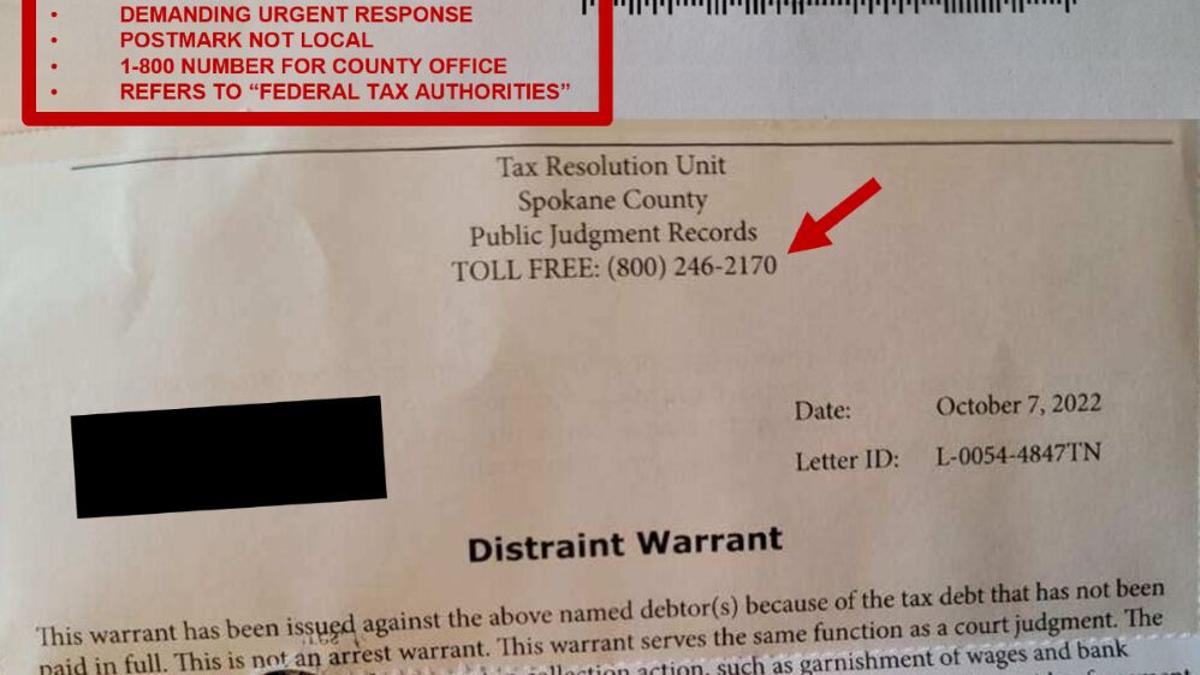

Enterprise Title Don T Be Fooled By Scammers A Homeowner Received This Notice Regarding The Previous Owner Of Their Property Interestingly Enough The Prior Owner Did Have A Tax Warrant Against Them

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

The Essential List Of Tax Lien Certificate States

How To Buy A Tax Sale Property In Indiana

Why And How To Apply For A Federal Tax Lien Subordination

Owing Money To The Indiana Department Of Revenue Dutton Legal Group Llc

/cloudfront-us-east-1.images.arcpublishing.com/gray/TT232ZGFP5PGFJDLPW3GFC7OOY.jpg)

Deputies Warn Of New Tax Scam Ahead Of Filing Deadline

Estimated Income Tax Payments For 2022 And 2023 Pay Online

![]()

Dor Indiana Department Of Revenue

2017 General Update Ppt Download

Dor Owe State Taxes Here Are Your Payment Options

Dor Indiana Department Of Revenue